Issue # 3 | October 21, 2025

Navigating Rate Cuts and Regulatory Horizons

Welcome to Crypto Pulse

Welcome to the October 2025 edition of Anbruggen Capital Crypto Pulse!

Latest News

Crypto market endures largest liquidation event in history on October 10 amid geopolitical shocks

- On October 10, 2025, over $19 billion in leveraged positions were liquidated in a 24-hour period, the biggest wipeout ever recorded in crypto, triggered by renewed U.S.-China tariff threats that sparked panic selling. Bitcoin briefly plunged below $105,000, Ethereum dropped 12% to test $3,600 support, and the total market cap shed nearly $1 trillion.

- Analysts attribute the cascade to overleveraged positions, with CoinGlass data showing it was nine times larger than February 2025's crash and far exceeding the 2020 or FTX meltdowns.

- Analysts also alleged that the liquidations have been made worse by system malfunctions in the order processing and auto-deleveraging logic of Binance, the world’s largest crypto exchange.

Our Take: This flash crash exposed leverage risks in a maturing market, but it also flushed out weak hands, creating buying opportunities for long-term holders and institutions. Historical patterns show such events often precede rallies, and with no structural damage to fundamentals, the event can be viewed as a healthy correction rather than a trend reversal.

Anbruggen Capital does not use any form of leverage, nor does it have any form of margin trading that can be liquidated in such scenarios. Our strategies invest with diversification, disciplined position sizing, and a focus on fundamentals. This allows us to handle unusually volatile events and manage portfolio risks prudently while maintaining the capability to bet on a potential recovery.

Bitcoin and Ethereum lead swift recovery, signaling 'Uptober' remains intact

- By October 20, Bitcoin had rebounded to $110,600, Ethereum gained ground to $3,900, and the global market cap climbed back to $3.7 trillion, went to as high as 3% in a single day, with 7 of the top 10 coins in the green. Analysts cite seasonal October bullishness ("Uptober") and possible gold market rotations as drivers.

- Institutional inflows resumed post-crash, with Bitcoin ETFs seeing net additions and wrapped assets stabilizing, bolstering confidence in a quick rebound.

Our Take: The rapid recovery underscores crypto's resilience, driven by positive seasonality, lower interest rates, and growing institutional adoption. This positions the market for potential year-end gains, though we still advise being cautious and expect further volatility as market sentiment and capital might need more time to be rebuilt.

SEC expands "Project Crypto" with new stablecoin guidelines, easing compliance for institutions

- Building on September's framework, the SEC issued updated stablecoin oversight rules on October 16, emphasizing transparency and reserves, which has been welcomed by issuers like Tether and Circle.

- Industry feedback highlights reduced regulatory uncertainty, potentially accelerating billions in fresh capital inflows.

Our Take: These developments reinforce mainstream integration, providing a counterbalance to short-term shocks. Compliant assets like ETH and stablecoins stand to benefit most, potentially making selective exposure to DeFi ecosystems a strategic play for bullish outlooks.

Global Macro View

Following September's 25bps rate cut to 4.00-4.25%, the Federal Reserve is poised for another quarter-point reduction at its October 29-30 meeting, targeting 3.75-4.00%, amid softening economic indicators. Recent data shows CPI steady at around 2.9% y/y (in line with expectations), PPI cooling further, and job openings reflecting a weakening labor market, echoing August's downward revisions of 911,000 nonfarm payrolls. Geopolitical tensions, including tariff escalations, added pressure but haven't derailed the dovish stance. Lower rates continue to favor risk assets like crypto, with analysts expecting this cycle to support a rebound despite October's volatility.

References:

- Fed Rate Expectations - https://www.reuters.com/business/finance/fed-still-poised-cut-rates-worries-mount-over-us-data-vacuum-2025-10-20/

- Economic Data Schedules - https://www.bls.gov/schedule/

Crypto Spotlight

Bitcoin (BTC) emerges as October's resilient outperformer

Despite the liquidation event, BTC has outperformed major altcoins month-to-date, holding key support and leading the recovery rally. Its dominance in institutional portfolios and ETF inflows highlight its role as a safe-haven asset in turbulent times.

Chartbook

Bitcoin (BTC)

Weekly upward trend on Bitcoin remains intact as the drop served as a retest of the channel trendline support. A possible retest of the 50 exponential moving average support is still on the table.

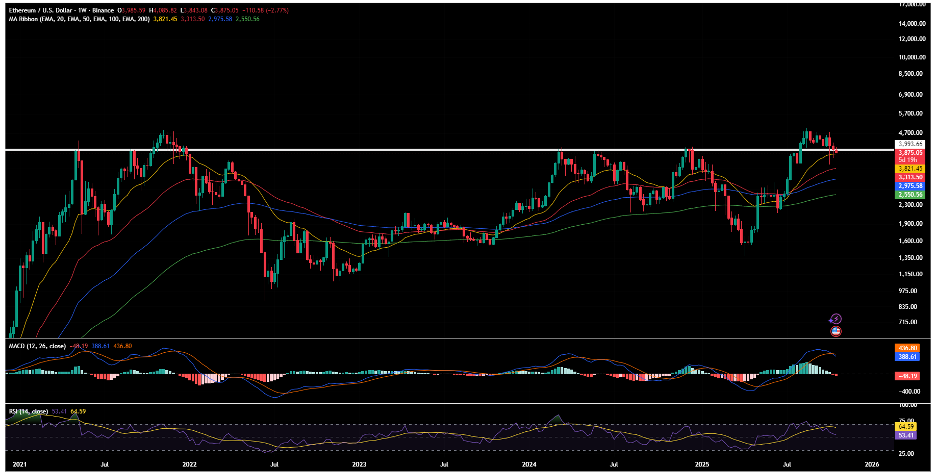

Ethereum (ETH)

Price continues to test resistance turned support. The long wick created by quick bounce from the massive drop signifies a possible strong support at this area.

Solana (SOL)

Weekly uptrend still intact as price continues to retest channel trendline and exponential moving average support.

Binance Coin (BNB)

BNB is still on an uptrend as it created its current all time high of $1,375. Currently pulling back to retest support and gather liquidity for a possible move higher.

Looking Ahead

The Fed's anticipated October rate cut will set the tone for Q4, with lower borrowing costs likely amplifying crypto's bullish seasonality. While the liquidation event tested resilience, swift recoveries and strong fundamentals, including ETF momentum and regulatory clarity, keep us cautiously optimistic. We continue monitoring geopolitical risks and prioritizing high-quality projects with robust ecosystems. Contact us at [email protected] to refine your portfolio for this rate-cutting cycle and partner with experts navigating crypto's opportunities.

Disclaimer: Investing in cryptocurrencies involves significant risk. Past performance does not guarantee future results. Consult a financial advisor before making investment decisions.